Reserve Funds – What You Need to Know

Once the Sectional Titles Schemes Management Act comes into force Reserve Funds for bodies corporate will be mandatory and the Minister will prescribe mandatory minimum amounts… This means that the lax attitude most bodies corporate in South Africa have been taking towards reserve funds will no longer be an option.

We need to know about Reserve Funds and Reserve Fund Planning. This post hopes to help get you started!

What is a Reserve Fund?

It is a fund set up by the body corporate to cover the costs of future capital expenses such as painting the building, driveway refurbishment, replacement of common property items like carpets, roofing, guttering, lifts and so on.

What is a Reserve Fund Plan?

A long-range financial planning tool that provides a funding plan to offset the anticipated costs of repairs to and replacement of common property assets.

Translation: It’s a report that tells the BC –

- What common property assets it owns

- When these need to be repaired and replaced

- A realistic estimate of what the repairs and replacement will cost

- How this money should be raised

What’s the Purpose of Having a Reserve Fund and a Reserve Fund Plan

- To keep the market value of the units in the scheme up

- Regular reserve fund contributions = fewer special levies: This proactive approach means owners understand their regular liabilities and when they occur rather than getting nasty surprises when the BC is forced to react to an unplanned major expense.

Developing a Reserve Fund Plan

Developing a Reserve Fund Plan

In the sectional title industry overseas there are companies that specialize in doing professional Reserve Fund Plans for sectional title schemes. In South Africa there may be companies that offer a similar service but it is also possible for the trustees, with the help of their managing agent if they have one, to put a Reserve Fund Plan together themselves. Here’s how:

Step 1: Make a List of all Common Property Assets

Put together a comprehensive list of all the common property assets which may include: fences, driveways, paving, letterboxes, intercom, plumbing system, lighting, outer-walls of the building, roofs, gardens, swimming pool, lifts, passages and so on.

Step 2: Estimate When Repairs Will Be Needed (How Long Do Things Last?)

Decide on a time-frame for repair work and replacement of items. Long-term owners or a managing agent that has been looking after the scheme for many years may know from previous experience how often repairs and replacement of certain items are needed. Guarantees from previous contractors may also assist, for example if the company that last painted the building gave a 5 year guarantee you can assume repainting will be needed 5 years from the date the building was last painted. Warranty statements or service plans may help you estimate the working life of items such as automated garage doors, communal washing machines and lawnmowers.

Step 3: Estimate Costs

Investigate the costs of repairing and replacing common property items. To obtain relatively accurate estimate costs we suggest you take inflation into account and obtain current quotes, talk to tradesmen, refer to service plans, previous quotes and invoices.

Step 4: Plan to Raise the Money Required

Once you’ve figured out how much money the BC needs to raise for the common property assets create a time line and figure out what annual allocation to the reserve fund is necessary. These amounts should then be included in the proposed budgets for the coming years as and when those budgets are drawn up.

While researching for this post I came across a great local article on reserve funds written by Michael Bauer of IHFM that you may find interesting: http://www.sapropertynews.com/reserve-funds-should-be-allowed-for-in-sectional-title-agm-budgets/

What are your thoughts on reserve funds and reserve fund planning? Do you do it? Or do your owners prefer the reactive ‘keep the levies down and pay special levies if and when necessary approach’? Share with us by commenting below…

Image 1 source: mashable.com

Info credit and image 2 source: http://www.choa.bc.ca/_updates/CHOA_Bill_8_Reserve_Study_Victoria.pdf

Hi – whilst reserve funds are often deemed to be too low, we have an instance that one of our owners feel that the reserve is too high. I would lean towards the term conservative so the question is, will upper limits be set as we – the trustees – feel that the “number” can be defended.

We are a relatively small block (19 units) and thus don’t have risks associated with elevators, swimming pools etc. but still feel that material issues such as the painting of the complex, emergency electrical and plumbing repairs or even perhaps the roof, can justify the amount we have in reserve.

Our reserve fund is R100, the trustees have spent the R1.2 million reserve fund on painting the complex and walls and repairing carports. In addition they spend R450 000 a year on security!!! why two security guards 24 hours a day when we all have remotes to open the large electric gates?

Anyway reserve is all of R100! not even a thousand!!!

Interesting situation in our complex – we have a decent reserve fund (around R500,000), yet the BC have decided to impose a 12-month special levy to “keep the reserves”… And they do not want to explain.

Whether the Amendment comes to fruition or not, we would strongly recommend that all BCs anyway bite the bullet and create reasonable reserves, Act or not.

We at Sundowners Creek have a reserve fund in place with large expenses (planned, unplanned and also to fund properly authorised luxurious items) in mind. Having gone through cycles of having and not having reserves, we learned the hard and expensive lessons that now stand us in good stead with regard to maintenance, repairs and replacements.

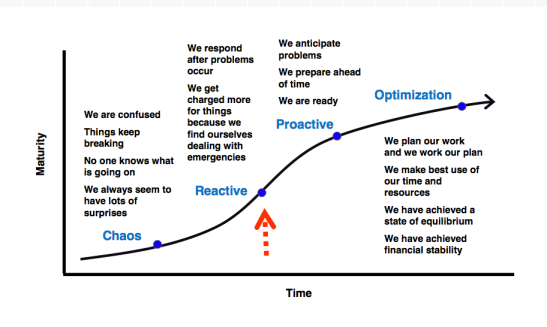

This has left us at a point of good financial stability as per your maturity graph and it is hard to see that we could be forced into special levies at any time forseeable.

An additional benifit of proper maintenance and replacement management is that it keeps levy increases as even and as low as can be.

It’s fine to say “once the amendments come into force” , any idea when “once” will be?

Secondly, is there a time limit laid down for the Body Corporate to comply and compile the “Reserve Fund Plan” ?

Lastly, is the Act available on the internet to download?

Thank you

Robert Matthee

Chairman

Riverside Bungalows B/C

Sabie

Hi Sabie, unfortunately we don’t know when “once” will be. We hope it will be this year but then again we thought it might be last year!! The new Act may be available for download on the Internet – you can do some Googling for the Sectional Titles Schemes Management Act 8 of 2011 and see if you can find a free download. Alternatively it is available to our Paddocks Club members http://www.paddocksclub.co.za on our Paddocks Club website but of course you’d need to be a member to access it.

A Formal Reserve fund sounds like an excellent idea because in older complexes one often find that the spending on maintenance eats away into spare cash and are often neglected as a result

Hi All,

We started with three additional categories in our Budget Plan..

It was well accepted by all the members when we explained the reason for a reserve fund.

We included:

1. Corrective Maintenance – Based on what we need to do according to our 5

year Maintenance Plan.

2. Preventative Maintenance – Based on additional work required as a result of

sooner as planned fading of paint etc.

3. Emergency Maintenance – This description explains itself.

We have this method in place for the past five years and we have a reasonable “Reserve Fund” in place. However we decided to make additional provision if the Government enforces the Law that Electric Fencing must be a certain height from the ground. It could mean the build-up of walls and to replace all electric fencing. That could be a ‘Bummer” on many Complex Budgets.

Thank you Jennifer, for articles of interest.

Best Regards

Hannes van Rensburg

Your welcome Hannes and thank you!

There is a disincentive for schemes to build up reserve funds – and this is that owners are effectively losing money, because bank savings accounts pay interest at below the inflation rate. In other words, schemes are “saving themselves poor”. The solution is to amend PMR 43 so that BCs can put surplus funds into other instruments, such as money market unit trust funds. BCs can amend PMR 43 to invest in all kinds of instruments, including equities, but, the higher the potential return, the higher the risk, and BCs could find themselves getting into all sorts of trouble if trustees try to act as financial advisers. Ideally, the government should allow BCs to invest in zero-cost, very low risk RSA Retail Bonds, which pay an inflation-related return. Unfortunately, currently only natural persons may invest in retail bonds.

There is a disincentive for schemes to build up reserve funds – and this is that owners are effectively losing money, because bank savings accounts pay interest at below the inflation rate. In other words, schemes are “saving themselves poor”. The solution is to amend PMR 43 so that BCs can put surplus funds into other instruments, such as money market unit trust funds. BCs can amend PMR 43 to invest in all kinds of instruments, including equities, but, the higher the potential return, the higher the risk, and BCs could find themselves getting into all sorts of trouble if trustees try to act as financial advisers. Ideally, the government should allow BCs to invest in zero-cost, very low risk RSA Retail Bonds, which pay an inflation-related return. Unfortunately, currently only natural persons may invest in retail bonds.

This is a very interesting point! I am currently studying this for my block, The Australians are well ahead in this area. I am trying to discover if there is a “third way here”, ie design a sinking fund to collect say 50% of the monies required for the sinking fund from the monthly levies and save in a no-risk investment (looses a little but provides the saving opportunity), and plan special levies (say one per year on the same date, or just prior to planned major expense) in order to bump up the sinking fund.

This way, not all the required sinking fund reserves are sitting idle for years and owners don’t loose the opportunity of allocating their savings elsewhere, and as special levies are planned a long way in advance, they are not such a shock and owners can save for them.

Reserve fund health should be an appraisable metric, so any potential buyer can quickly see how much levy risk any one apartment carries,

Good Evening,

We have a reserve fund, and believe me this is a great fund to have. We are in the space at the moment where we are to repaint the complex and repair some of the entrences to the garages. What a pleasure to not have to burden the owners at this time of the year with special levies. Wallet strings are tight right now with all the increases in the economy and still having to face increase of levies after the next AGM.

Dolores

Well done Dolores – you and your fellow owners are feeling the benefit of having a properly managed reserve fund. This is great to see 🙂

Thanks Butch! If only more people thought like you 🙂

Section 37(1)(a) of the Act requires that reasonable provision for future maintenance and repairs is provided for and, as you say, PMR 36(2) mentions contingencies – but these provisions are interpreted subjectively and some people think that it is reasonable not to budget anything for future maintenance and repairs/contingencies.

This area will be more regulated when the new legislation comes into effect which I think will be a good thing!

Hi Jennifer

Great article!

The present Management Rules 36(2) talk about the budget having sufficient funds for Contingencies, which i interpret as the Reserve Fund.

Butch

Hi Alwyn – the Regulations have not yet been approved and I believe that is the hold up… I’m impressed to hear Walmer Park One has a good reserve fund and it’s working well for your scheme. Well done!

Why do ypu think they are delaying the implementation of the Act It is already 2014

At Walme rPark One we started a five year rolling plan many years ago and we have built a maintenance reserve to such an extent that special levies are not necessary